Help manage unanticipated risks

With the Nationwide Defined Protection® Annuity 2.0

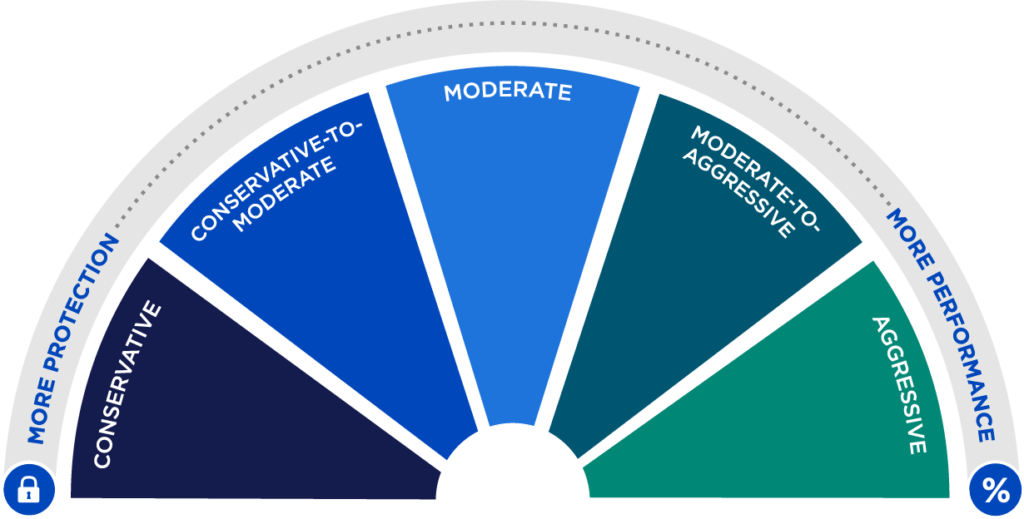

Align performance and protection needs

Investors face a unique challenge – how to create greater growth opportunities without taking on significant risk – when planning for retirement. It’s important to evaluate how investments are aligned to needs across an entire retirement portfolio.

Risks to consider

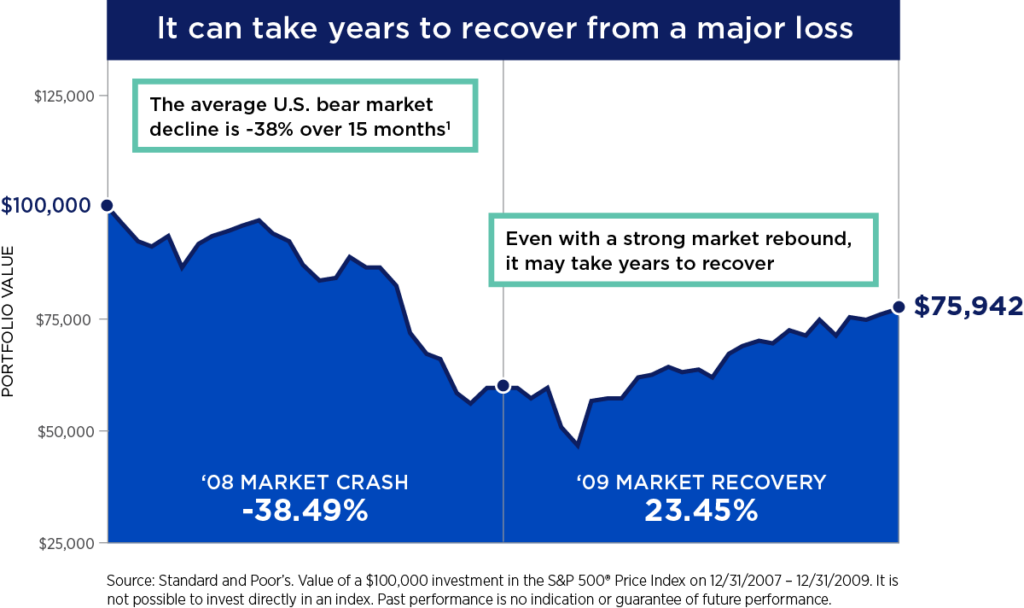

Market changes can be sudden and severe

Since 2009, U.S. equities have experienced one of the longest sustained bull markets in history, which may have caused investors to forget about the severity of the last market crash. It is important to consider how a loss of 30% or more would impact a retirement plan.

New Innovations can help manage the variety of risks to retirement portfolios

That’s why we created Defined Protection

Achieve a balance

Discover balance with the dynamic

Protection + Performance Tool

The Nationwide Defined Protection Annuity® 2.0 is not available in NY, OR, VI as of 04/07/25.

What is the Defined Protection Annuity?

The Nationwide Defined Protection® Annuity 2.0 is a single purchase payment deferred annuity contract issued by Nationwide Life Insurance Company. In exchange for your investment, you’ll receive growth opportunities based on the performance of an underlying index and some protection, at a level you select, from negative performance. Defined Protection Annuity does not directly participate in any stock, equity investments or index. It is not possible to invest directly in an index.

- Withdrawals will reduce the Contract Value and Death Benefit. Some withdrawals may be subject to early surrender charges and adjustments

- If you take withdrawals before you’re age 59½, you may have to pay a 10% federal tax penalty in addition to ordinary income taxes

- All guarantees and protections of this annuity are subject to the financial strength and claims-paying ability of Nationwide Life Insurance Company

Please consult the prospectus for more information.

1 Source: Morningstar, 6/28/2019. The average bear market (20% or greater loss from a previous high) lasts 1.3 years.

Not a deposit – Not FDIC or NCUSIF insured – Not guaranteed by the institution – Not insured by any federal government agency – May lose value

This material is not a recommendation to buy or sell a financial product or to adopt an investment strategy. Investors should discuss their specific situation with their financial professional.

This product is sold by prospectus. This material must be preceded or accompanied by the prospectus. Carefully consider the investment objectives, risks, charges and expenses. The product prospectus contains this and other important information. Investors should read them carefully before investing. To request a copy, go to nationwide.com/prospectus or call 1-800-848-6331.

Index-linked annuity contracts are complicated investments. Prospective purchasers should consult with a financial professional about the Contract’s features, benefits, risks, and fees and whether the contract is appropriate based upon his or her financial situation and objectives.

Annuities have limitations. They are long-term vehicles designed for retirement purposes. They are not intended to replace emergency funds, to be used as income for day-to-day expenses or to fund short-term savings goals. Withdrawals are subject to income tax, and withdrawals before age 59½ may be subject to a 10% early withdrawal federal tax penalty. Please read the contract for complete details.

Nationwide Defined Protection® Annuity 2.0 is an individual single purchase payment deferred annuity with index-linked strategies issued by Nationwide Life Insurance Company, Columbus, Ohio. The general distributor is Nationwide Investment Services Corporation, Member FINRA. Please note that the Defined Protection Annuity does not directly invest in an index. The product includes index strategies which follow market performance; however, they are not actual investments in the stock market.

Guarantees and protections referenced within are subject to the claims-paying ability of Nationwide Life Insurance Company.

Nationwide, the Nationwide N and Eagle, Nationwide is on your side, and Nationwide Defined Protection are service marks of Nationwide Mutual Insurance Company. © 2025 Nationwide

VAW-0270AO (4/25)