American Funds®

The Growth Fund of America® – Class F-3

Helpful Resources

Top Equities

As of 12/31/2024

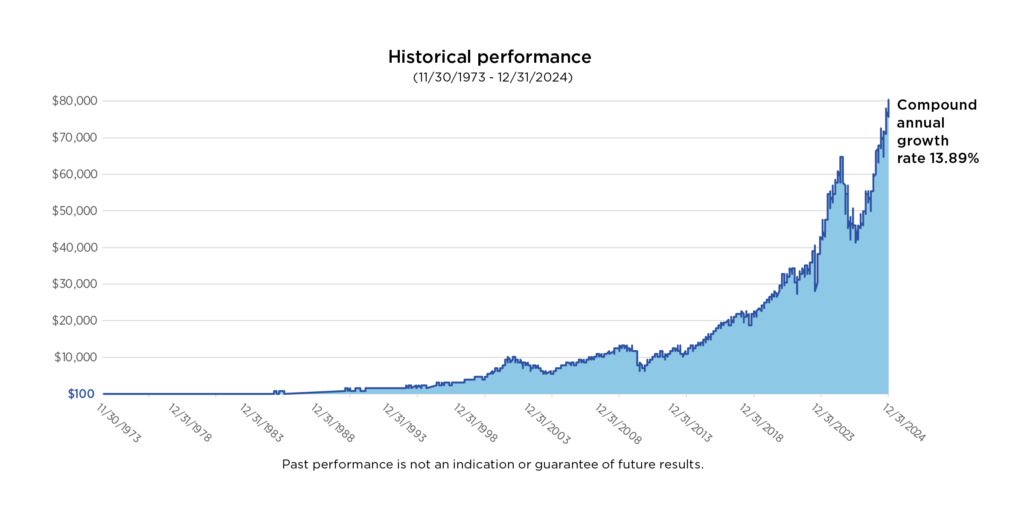

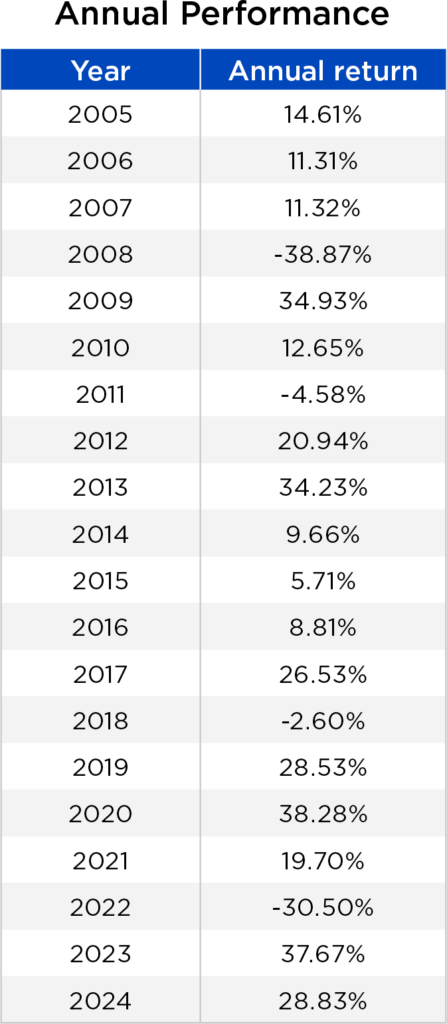

Important Information regarding American Funds The Growth Fund of America Class F-3 Fund (GFA): This fund was initially established on 12/1/1973. The values displayed are based on the official, daily total returns of the fund calculated in accordance with the SEC Form N-1A (prospectus) average annual total return quotation methodology. Historical daily return data includes hypothetical returns prior to the inception date of the F-3 share class on 1/27/2017. Hypothetical returns are calculated by adjusting the results of the original share class of the fund, without a sales charge, by the typical estimated expenses of the subsequent share class since inception. Past performance is not indicative of nor does it guarantee future performance. The results shown are hypothetical and do not reflect actual investment results. Actual results may differ.

Please be aware that sub-period returns, like the official 1-day return, will not match up exactly to longer-period returns when chain-linked together to generate longer-period returns. The return differences based on using the Form N-1A methodology versus the chain-linking methodology are small basis point differences for standard periods (1, 5, 10-year, etc.) but could be larger for longer periods, such as the lifetime of the fund.

This material provides information on American Funds® The Growth Fund of America® – Class F-3 and should be used in conjunction with the product prospectus.

Investing for growth, the fund offers a diversified approach to long-term capital appreciation to help investors pursue long-term goals.

A broad mandate

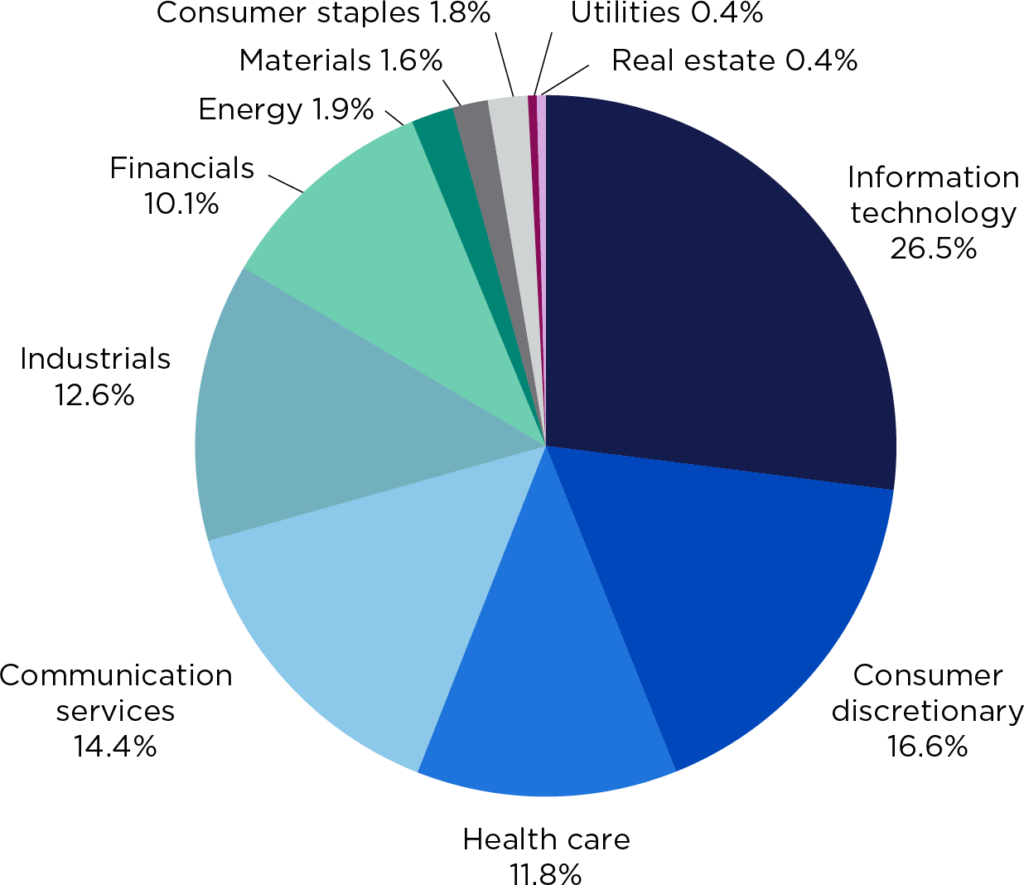

Unlike some growth funds with a narrow investment universe, the fund can invest wherever growth opportunities may be, including up to 25% of assets outside the U.S. These investments often include:

- Traditional growth stocks

- Stocks of companies that are cyclical

- Stocks of companies that are depressed or in turnaround situations

Company-by-company approach

The fund is focused on companies – not on specific market capitalizations, industries or sectors. The managers rely on in-depth global research to find companies that they believe have sound fundamentals and sustainable competitive advantages. As of its fiscal year-end on 8/31/24, the fund’s portfolio included investments in approximately 293 companies.

Long-term focus

The investment professionals for the fund search for companies that they believe offer opportunities for capital appreciation over the long haul. This long-term focus has helped the fund outpace the S&P 500®, Russell 1000 Growth Index and more traditional large-capitalization growth investments from 12/31/1978 to 8/31/2024.

Sector Breakdown:

As of 12/31/2024

American Funds® The Growth Fund of America® – Class F-3 is not a market Index. It is a mutual fund, and its Index Value reflects the mutual fund’s total return. If you select a mutual fund-linked index Strategy for investment, you will not be investing in the linked mutual fund. You will not be a shareholder or beneficial owner of the fund and you will have no rights with respect to the fund. This example is not a projection or prediction of future performance. The performance could be significantly different than the performance shown and shouldn’t be considered a representation of investor experience in the future.

The Nationwide Defined Protection Annuity® 2.0 is not available in NY, OR, VI as of 04/07/25.

1 American Funds® The Growth Fund of America® – Class F-3 is not a market Index. It is a mutual fund, and its Index Value reflects the mutual fund’s total return. If you select a mutual fund-linked index Strategy for investment, you will not be investing in the linked mutual fund. You will not be a shareholder or beneficial owner of the fund and you will have no rights with respect to the fund.

Not a deposit – Not FDIC or NCUSIF insured – Not guaranteed by the institution – Not insured by any federal government agency – May lose value

This material is not a recommendation to buy or sell a financial product or to adopt an investment strategy. Investors should discuss their specific situation with their financial professional.

This product is sold by prospectus. Carefully consider the investment objectives, risks, charges and expenses. The product prospectus contains this and other important information. Investors should read them carefully before investing. To request a copy, go to nationwide.com/prospectus or call 1-800-848-6331.

Index-linked annuity contracts are complicated investments. Prospective purchasers should consult with a financial professional about the Contract’s features, benefits, risks, and fees and whether the contract is appropriate based upon his or her financial situation and objectives.

Annuities have limitations. They are long-term vehicles designed for retirement purposes. They are not intended to replace emergency funds, to be used as income for day-to-day expenses or to fund short-term savings goals. Withdrawals are subject to income tax, and withdrawals before age 59½ may be subject to a 10% early withdrawal federal tax penalty. Please read the contract for complete details.

Nationwide Defined Protection® Annuity 2.0 is an individual single purchase payment deferred annuity with index-linked strategies issued by Nationwide Life Insurance Company, Columbus, Ohio. The general distributor is Nationwide Investment Services Corporation, Member FINRA. Please note that the Nationwide Defined Protection® Annuity and Nationwide Defined Protection® Annuity 2.0 do not directly invest in an index. The products include index strategies which follow market performance; however, they are not actual investments in the stock market.

The Index Strategies linked to American Funds® The Growth Fund of America® are not market indexes. They are based on a retail mutual fund whose investment returns are used to determine the performance of the associated Index Strategies. You will not become a shareholder of the mutual fund by investing in the Index Strategies, nor will you have any voting, dividend, liquidation, or any other rights typically afforded to the mutual fund’s shareholders. American Funds® The Growth Fund of America® and its trademarks and data have been licensed for use by Nationwide Life Insurance Company and Nationwide Life and Annuity Insurance Company. All Capital Group trademarks mentioned are owned by The Capital Group Companies, Inc. (“Capital Group”) or an affiliated company or fund. All other company and product names mentioned are the property of their respective companies. This Product is not sponsored, endorsed, recommended, offered, sold, issued or promoted by Capital Group or any of its affiliates, or any of their respective third-party licensors. Capital Group has no obligation or liability in connection with the administration or marketing of this Product. Capital Group makes no representation or warranty, express or implied, to the owners of this Product or any member of the public regarding the suitability or advisability of investing in this Product or any Index Strategy. Capital Group has not prepared any part of this document and no statements made herein should be attributed to Capital Group.

The Product is not an investor in American Funds® The Growth Fund of America®, and The Growth Fund of America is managed by Capital Group without regard to Nationwide or the Product. Capital Group is not an investment adviser to, and owes no fiduciary duty to, Nationwide, the Product, or the owners of the Product. Capital Group is under no obligation to continue managing or sponsoring The Growth Fund of America and may change its investment strategies, portfolio management team, portfolio investments, or other features at any time without regard to Nationwide or the Product. Past performance of The Growth Fund of America is not an indication or guarantee of future results, and there can be no assurance that The Growth Fund of America will provide positive investment returns. More information about the investment strategies and risks of The Growth Fund of America can be found in The Growth Fund of America’s prospectus.

Neither this document nor any other efforts by Nationwide or its affiliates to administer or market this Product or the Index Strategies associated with The Growth Fund of America is, or is intended to be, an offer to purchase shares of or otherwise invest in The Growth Fund of America.

Nationwide, the Nationwide N and Eagle, Nationwide is on your side, and Nationwide Defined Protection are service marks of Nationwide Mutual Insurance Company. ©2025 Nationwide

VAW-0290AO (4/25)