A strong partner today helps meet goals for tomorrow. That’s why we designed a new retirement solution to help balance protection and performance needs, backed by a company that’s committed to doing right by our members. Define a retirement with the Nationwide Defined Protection® Annuity 2.0 (Defined Protection Annuity).

Protection

Limit losses based on the protection level you choose

Performance

Index-linked and fixed-rate growth opportunities

Strength

Guarantees are backed by Nationwide®

An opportunity for consistent long-term growth

Define a personalized protection and growth strategy with the Protection + Performance Tool

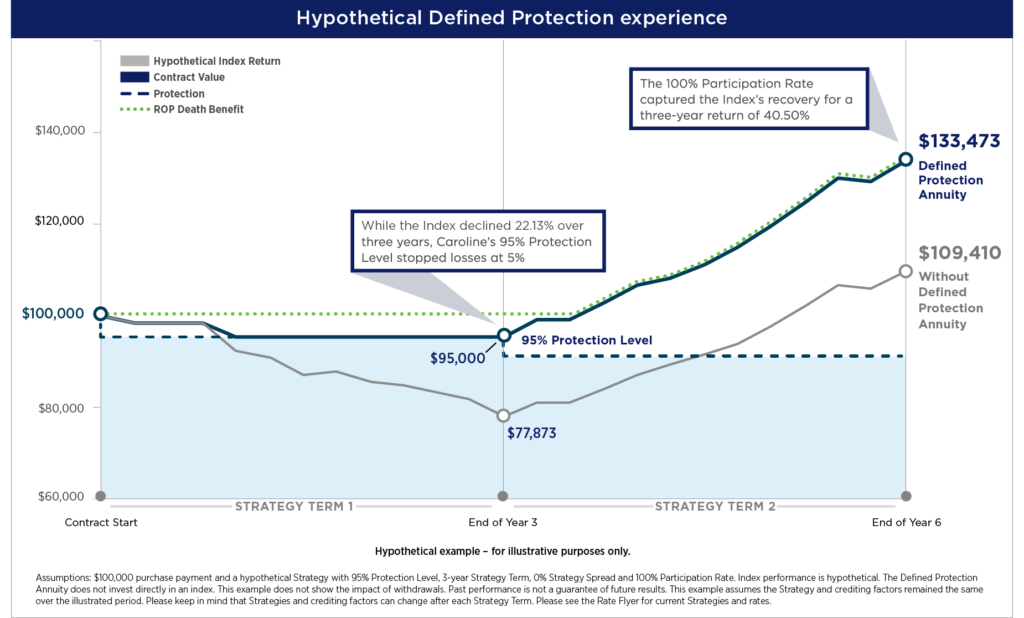

Hypothetical Example: The purpose of this hypothetical example is to demonstrate how Defined Protection Annuity and its Strategy Options would have performed under various selected scenarios. Crediting rates are guaranteed for the first Strategy Term only and subject to change each additional Strategy Term. This product is new and has a limited performance history. This hypothetical example is not intended as a projection of future investment results, nor is it intended as financial planning or investment advice. Past performance is not a guarantee of future results. Actual results may vary.

Protection from potential market losses

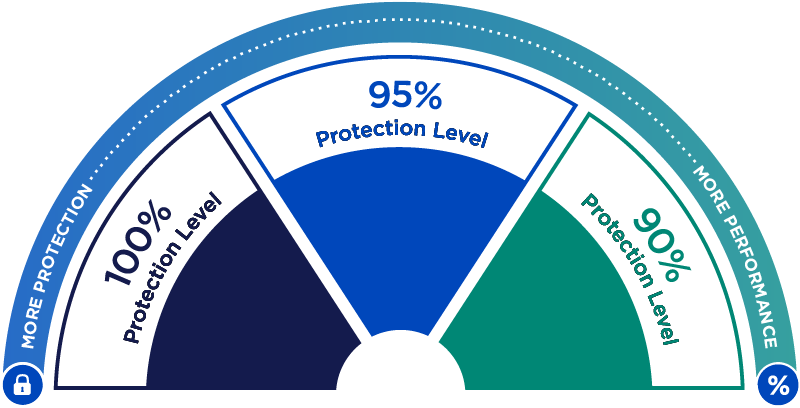

The Defined Protection Annuity offers three Protection Levels, providing the opportunity to determine how much of the investment is protected from market losses during each Strategy Term.1

Define a protection

100% Protection Level

Provides the most protection from index losses during the Strategy Term.

95% Protection Level

Limits index losses to 5% over the Strategy Term.

90% Protection Level

Protects contract from losses exceeding 10% per Strategy Term.

Please note that Defined Protection Annuity does not directly participate in any stock, equity investments or index. It is not possible to invest directly in an index. Not all Strategies may be available at all times or in all states.

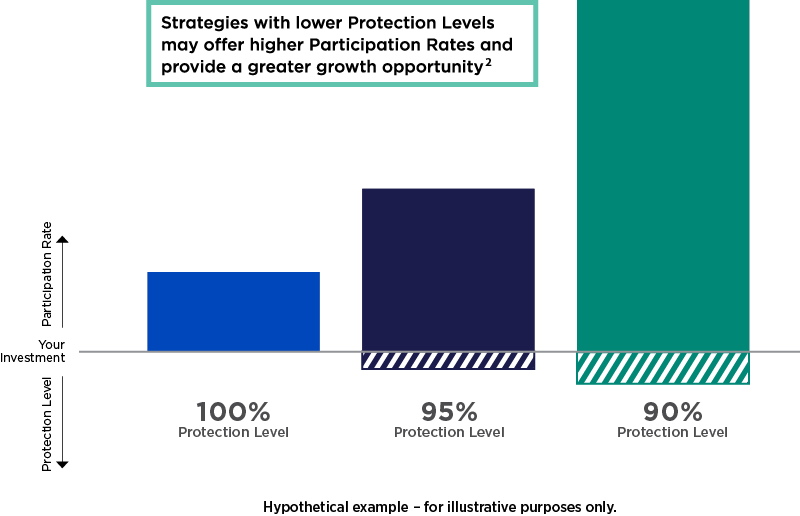

Increase index growth opportunity

Defined Protection Annuity offers a unique combination of performance and protection to help address today’s retirement challenges. Positive Index performance during the Strategy Term may help grow an investment.

Customize a Strategy

Market Index

The Defined Protection Annuity 2.0 offers a variety of traditional and exclusive indices selected to provide diversified growth opportunities.

Strategy Term

Customize when earnings, if any, are credited.

Strategy Spread

Strategies featuring a Spread typically provide higher Participation Rates that could provide higher earnings during periods of average to strong Index performance but could also result in lower earnings or increased losses during periods of weak or negative Index performance.

The Nationwide Defined Protection Annuity® 2.0 is not available in MO, NY, OR, VA, VI as of 9/13/24.

1 The Protection Level represents the amount of downside protection (100%, 95% or 90%) during the Strategy Term.

2 A variety of Participation Rates will be available based on the Strategy you elect. A Participation Rate less than 100% will reduce the impact of both positive or negative Index performance. A Participation Rate greater than 100% will amplify the impact of Index performance whether positive or negative. The Protection Level will help stop losses regardless of the Participation Rate.

Not a deposit – Not FDIC or NCUSIF insured – Not guaranteed by the institution – Not insured by any federal government agency – May lose value

This material is not a recommendation to buy or sell a financial product or to adopt an investment strategy. Investors should discuss their specific situation with their financial professional.

This product is sold by prospectus. This material must be preceded or accompanied by the prospectus. Carefully consider the investment objectives, risks, charges and expenses. The product prospectus contains this and other important information. Investors should read them carefully before investing. To request a copy, go to nationwide.com/prospectus or call 1-800-848-6331.

Index-linked annuity contracts are complicated investments. Prospective purchasers should consult with a financial professional about the Contract’s features, benefits, risks, and fees and whether the contract is appropriate based upon his or her financial situation and objectives.

Annuities have limitations. They are long-term vehicles designed for retirement purposes. They are not intended to replace emergency funds, to be used as income for day-to-day expenses or to fund short-term savings goals. Withdrawals are subject to income tax, and withdrawals before age 59½ may be subject to a 10% early withdrawal federal tax penalty. Please read the contract for complete details.

Nationwide Defined Protection® Annuity 2.0 is an individual single purchase payment deferred annuity with index linked strategies issued by Nationwide Life Insurance Company, Columbus, Ohio. The general distributor is Nationwide Investment Services Corporation, Member FINRA. Please note that the Defined Protection Annuity does not directly invest in an index. The product includes index strategies which follow market performance; however, they are not actual investments in the stock market.

Guarantees and protections referenced within are subject to the claims-paying ability of Nationwide Life Insurance Company.

Nationwide, the Nationwide N and Eagle, Nationwide is on your side, and Nationwide Defined Protection are service marks of Nationwide Mutual Insurance Company. © 2024 Nationwide

VAW-0269AO (9/24)