Access broadly diversified

growth opportunities

Nationwide Defined Protection® Annuity 2.0 offers a variety of Strategies to help meet investment goals. Each of the crediting factors below impacts the Participation Rate growth opportunity. Up to 10 Strategies may be allocated at contract issue and re-allocated at the end of each Strategy Term.

Find a growth opportunity

Define your Protection Level

Choosing a lower Protection Level, the amount of downside protection under a Strategy, can increase the Participation Rates and lead to a greater growth opportunity.

Select the Index

- BlackRock Select Factor Index

- J.P. Morgan Mozaic II℠ Index

- MSCI EAFE Index

- NYSE® Zebra Edge® Index

- SG Macro Compass Index

- S&P 500® Average Daily Risk Control 10% USD Price Return Index

- S&P 500® Price Index

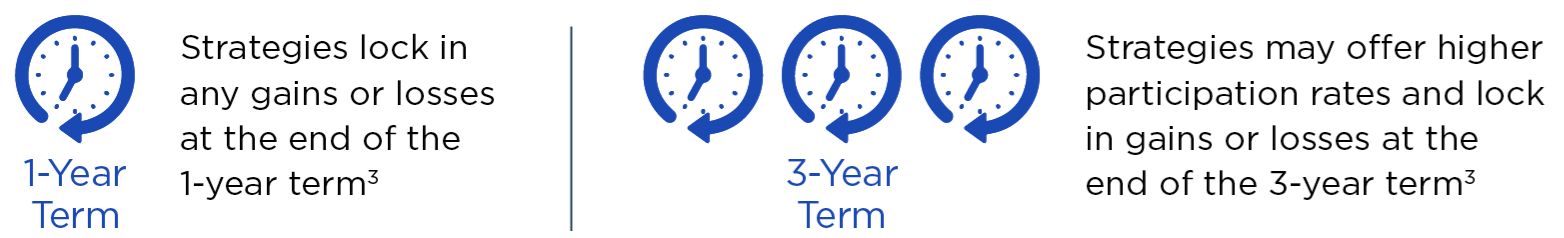

Choose the Strategy Term

Select a Strategy Spread

Index Strategies featuring a Spread typically provide higher Participation Rates that could provide higher earnings during periods of average to strong Index performance, but could also result in lower earnings or increased losses during periods of weak or negative Index performance.2

Important information: This is not a recommendation and does not constitute advice. Please review the current rate sheet for the current Strategies available. Nationwide reserves the right to add or remove the Index Strategies offered, change the Indexes, and limit the number of offered Index Strategies to only one. There is no guarantee that any specific Index Strategy will be available for the life of the Contract or even throughout the CDSC Period and MVA Period. Not all Strategies may be available at all times or in all states. Protection Levels are guaranteed at contract issue for the first Strategy Term and subject to change in each following Strategy Term.

Diversified index options3

Click on the index name for more information about each index. The Nationwide Defined Protection® Annuity 2.0 is not a direct investment in any stock, equity investments or index. It is not possible to invest directly in an index. Please consult the prospectus for more information on the available index options and how index performance is used in the calculation of any interest earnings.

The Nationwide Defined Protection Annuity® 2.0 is not available in MO, NY, OR, VA, VI as of 9/13/24.

1 Index Strategy Earnings are calculated differently during a Strategy Term than on the Strategy Term End Date. Please refer to the prospectus for additional information.

2 An annualized percentage used as a deduction in the calculation of Strategy Earnings, subject to the downside protection provided by the Strategy.

3 Diversification does not assure a profit or protect against loss in a declining market.

Not a deposit – Not FDIC or NCUSIF insured – Not guaranteed by the institution – Not insured by any federal government agency – May lose value

This material is not a recommendation to buy or sell a financial product or to adopt an investment strategy. Investors should discuss their specific situation with their financial professional.

This product is sold by prospectus. This material must be preceded or accompanied by the prospectus. Carefully consider the investment objectives, risks, charges and expenses. The product prospectus contains this and other important information. Investors should read them carefully before investing. To request a copy, go to nationwide.com/prospectus or call 1-800-848-6331.

Index-linked annuity contracts are complicated investments. Prospective purchasers should consult with a financial professional about the Contract’s features, benefits, risks, and fees and whether the contract is appropriate based upon his or her financial situation and objectives.

Annuities have limitations. They are long-term vehicles designed for retirement purposes. They are not intended to replace emergency funds, to be used as income for day-to-day expenses or to fund short-term savings goals. Withdrawals are subject to income tax, and withdrawals before age 59½ may be subject to a 10% early withdrawal federal tax penalty. Please read the contract for complete details.

Nationwide Defined Protection® Annuity 2.0 is an individual single purchase payment deferred annuity with index-linked strategies issued by Nationwide Life Insurance Company, Columbus, Ohio. The general distributor is Nationwide Investment Services Corporation, Member FINRA. Please note that the Nationwide Defined Protection® Annuity 2.0 does not directly invest in an index. The product includes index strategies which follow market performance; however, they are not actual investments in the stock market.

Some of the Indexes include income from any dividends paid by component companies. The exclusion of dividends from an Index may lower the Index Performance, particularly over the course of time.

BlackRock Select Factor Index, J.P. Morgan Mozaic II℠ Index, NYSE® Zebra Edge® Index, and SG Macro Compass Index are excess return indexes. Indexes calculated on an excess return basis include calculation elements that reduce index performance. Because of this, an excess return version of an index will have lower performance than a total return version of the same index would, especially in high interest rate environments. Some excess return indexes also deduct certain notional charges in calculating index performance. Any such deductions will reduce the potential positive change in index performance and increase the potential negative change in the index performance.

An Index Strategy that uses a reference index that takes measures to control volatility (in an attempt to limit the index’s highs and lows) generally offers greater participation rates than are offered with other Index Strategies. There is no guarantee that selecting an Index Strategy with a volatility control reference index will result in greater earnings credited to your contract than an Index Strategy that does not use a volatility control reference index, or that any earnings will be credited for a particular Index Strategy Term.

Guarantees and protections referenced within are subject to the claims-paying ability of Nationwide Life Insurance Company.

Past performance is not an indication of future results.

The BlackRock Select Factor Index (“Index”) is a product of BlackRock Index Services, LLC and has been licensed for use by Nationwide Life Insurance Company and Nationwide Life and Annuity Insurance Company (“Licensee”). BlackRock®, BlackRock Select Factor Index and the corresponding logos are registered and unregistered trademarks of BlackRock. This Product is not sponsored, endorsed, sold or promoted by BlackRock Index Services, LLC, BlackRock, Inc., or any of its affiliates, or any of their respective third party licensors (including the Index calculation agent, as applicable) (collectively, “BlackRock”). BlackRock has no obligation or liability in connection with the administration or marketing of this Product. BlackRock makes no representation or warranty, express or implied, to the owners of this Product or any member of the public regarding the advisability of investing in this Product or the ability of the Index to track general market performance. BlackRock does not guarantee the adequacy, accuracy, timeliness, and/or completeness of the Index or any data or communication related thereto nor does it have any liability for any errors, omissions or interruptions of the Index.

The J.P. Morgan Mozaic II℠ Index (“Index”) has been licensed to Nationwide Life Insurance Company (the “Licensee”) for the Licensee’s benefit. Neither the Licensee nor Nationwide Defined Protection® Annuity 2.0, (the “Product”) is sponsored, operated, endorsed, recommended, sold or promoted by J.P. Morgan Securities LLC (“JPMS”) or any of its affiliates (together and individually, “JPMorgan”). JPMorgan makes no representation and gives no warranty, express or implied, to contract owners taking exposure to the Product. Such persons should seek appropriate professional advice before making any in investment. The Index has been designed and is compiled, calculated, maintained and sponsored by JPMS without regard to the Licensee, the Product or any contract owner. JPMorgan is under no obligation to continue compiling, calculating, maintaining or sponsoring the Index. JPMorgan may independently issue or sponsor other indices or products that are similar to and may compete with the Index and the Product. JPMorgan may also transact in assets referenced in the Index (or in financial instruments such as derivatives that reference those assets). These activities could have a positive or negative effect on the value of the Index and the Product.

The NYSE® Zebra Edge® Index has been licensed by ICE Data Indices, LLC (together with its subsidiaries and affiliates, “ICE Data Indices”) to UBS AG and sub-licensed by UBS AG (together with its subsidiaries and affiliates, “UBS”) to Nationwide Life Insurance Company (“Nationwide”). Neither Nationwide nor any Nationwide Defined Protection Annuity 2.0 (the “Product”) is sponsored, operated, endorsed, recommended, sold or promoted by Zebra Capital Management, LLC (together with its subsidiaries and affiliates, “Zebra”), ICE Data Indices or UBS and in no event shall Zebra, ICE Data Indices or UBS have any liability with respect to the Product or the Index. Zebra, ICE Data Indices and UBS make no representations, give no express or implied warranties and have no obligations with regard to the Index, the product, the client or other third party.

The mark NYSE® is a registered trademark of NYSE Group, Inc., Intercontinental Exchange, Inc. (“ICE”) or their affiliates and is being utilized by ICE Data Indices, LLC under license and agreement. The marks Zebra® and Zebra Edge® are registered trademarks of Zebra Capital Management, LLC, may not be used without prior authorization from Zebra Capital Management, LLC, and are being utilized by ICE Data Indices, LLC under license and agreement.

The SG Macro Compass Index (the “SG Index”) is the exclusive property of SG Americas Securities, LLC (together with its affiliates, “SG”). SG has contracted with S&P Opco, LLC (a subsidiary of S&P Dow Jones Indices LLC) (“S&P”) to maintain and calculate the SG Index. “SG Americas Securities, LLC”, “SGAS”, “Société Générale”, “SG”, “Société Générale Indices”, “SGI”, and “SG Macro Compass Index” (collectively, the “SG Marks”) are trademarks or service marks of SG. The SG Index has been licensed to Nationwide Life Insurance Company (the “Licensee”) for use in the Nationwide Defined Protection® Annuity 2.0 (the “Product”). SG’s sole contractual relationship with the Licensee is as licensor of the SG Index and the SG Marks. SG has no obligation to make payments under the Product. None of SG, S&P or other third-party licensor (collectively, the “SG Index Parties”) to SG is acting, or has been authorized to act, as agent of the Licensee or has sponsored, promoted, solicited, negotiated, endorsed, offered, sold, issued, supported, structured or priced any Product or provided investment advice to the Licensee. The SG Index Parties make no representation or warranty, express or implied, to investors in the Product and hereby disclaim all warranties (including, without limitation, those of merchantability or fitness for a particular purpose or use): (a) regarding the advisability of investing in any products linked to the SG Index or (b) the suitability or appropriateness of an exposure to the SG Index in seeking to achieve any particular objective, including meeting its stated target volatility. No SG Index Party shall have any responsibility or liability for any losses in connection with the Product, including with respect to design, issuance, administration, actions of the Licensee, marketing, trading or performance of the Product. SG has not prepared any part of this document and no statements made herein can be attributed to SG.

SG does not act as an investment adviser or provide investment advice in respect of the SG Index or the Product and does not accept any fiduciary or other duties in relation to the SG Index, the Licensee, the Product or any investors in the Product. SG shall have no liability for any act or failure to act in connection with the determination, adjustment or maintenance of the SG Index. Without limiting the foregoing, SG shall have no liability for any damages or lost profits, even if notified of the possibility of such damages. In calculating the daily performance of the SG Index, SG deducts fixed transaction and replication costs that cover, among other things, rebalancing and replicating the SG Index. The total amount of these embedded costs is unpredictable and depends on numerous factors, including leverage of the SG Index, which may be as high as 200%, performance of indexes underlying the SG Index, market conditions and changes in the macro regimes, among other factors. The embedded costs, which are increased by the SG Index’s leverage, will reduce the performance of the SG Index. The volatility control applied by the SG Index may also reduce the overall return.

The product referred to herein is not sponsored, endorsed, or promoted by MSCI, and MSCI bears no liability with respect to any such product or any index on which such product is based. The Contract contains a more detailed description of the limited relationship MSCI has with Nationwide and any related funds.

The “S&P 500” is a product of S&P Dow Jones Indices LLC (“SPDJI”), and has been licensed for use by Nationwide Life Insurance Company (“Nationwide”). Standard & Poor’s®, S&P® and S&P 500® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”); DJIA®, The Dow®, Dow Jones® and Dow Jones Industrial Average are trademarks of Dow Jones Trademark Holdings LLC (“Dow Jones”); and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by Nationwide. the Product is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P 500.

S&P 500 Average Daily Risk Control 10% USD Price Return Index (“S&P 500 Average Daily Risk Control USD Price Return Index”) is a product of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”), and has been licensed for use by Nationwide. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by Nationwide. The Product is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P 500 Average Daily Risk Control 10% USD Price Return Index.

Nationwide, the Nationwide N and Eagle, Nationwide is on your side, and Nationwide Defined Protection are service marks of Nationwide Mutual Insurance Company. © 2024 Nationwide

VAW-0271AO (9/24)