The J.P. Morgan

Mozaic II℠ Index

An opportunity to pursue steady growth in a variety of markets

Helpful Resources

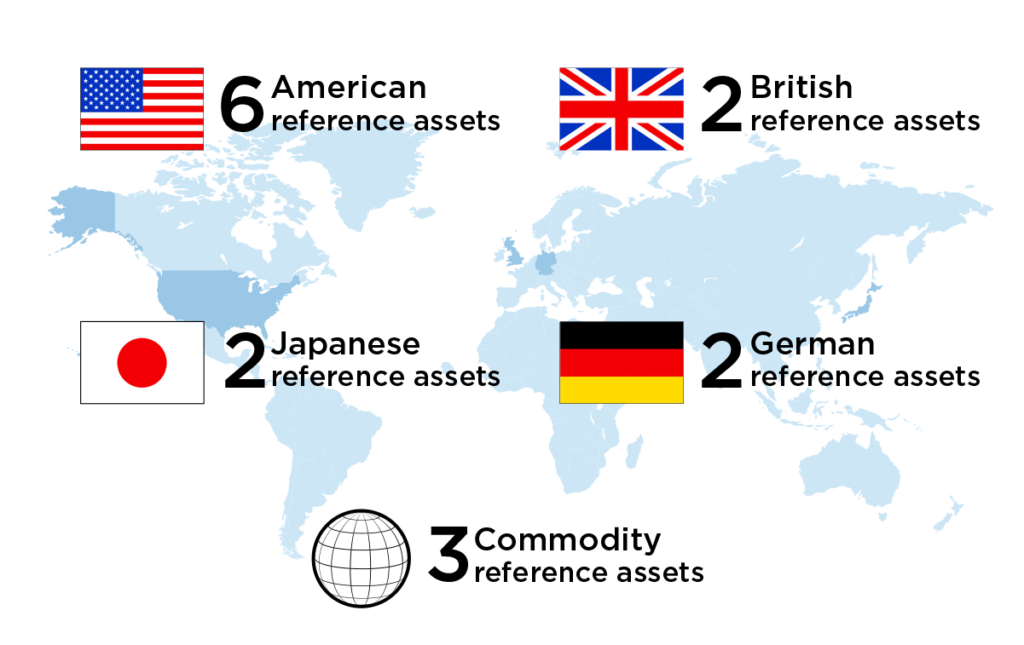

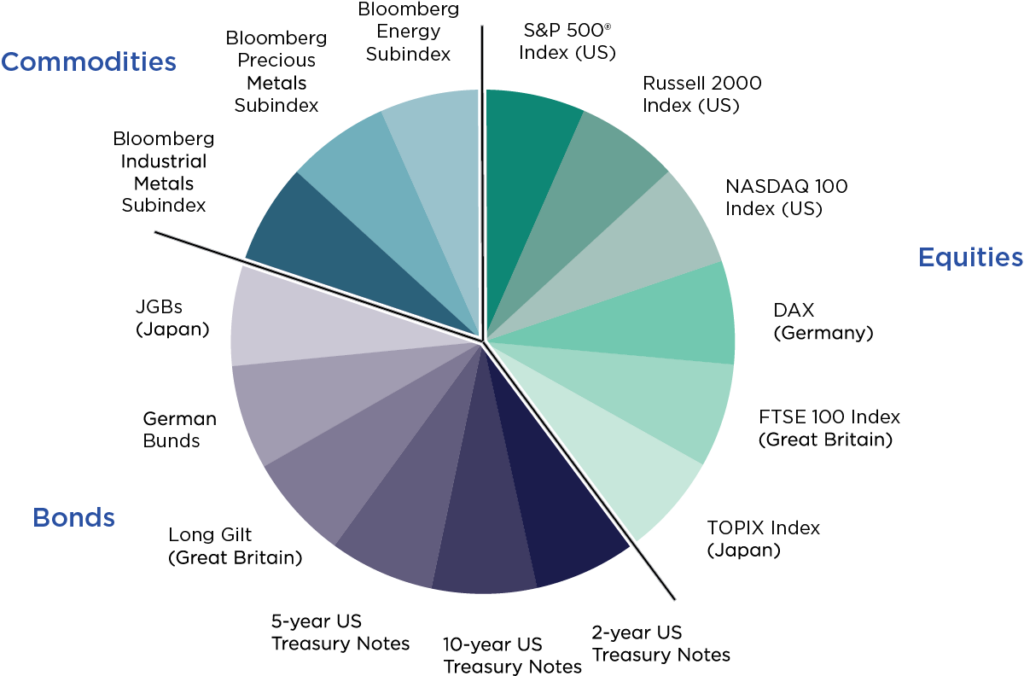

A broadly diversified approach

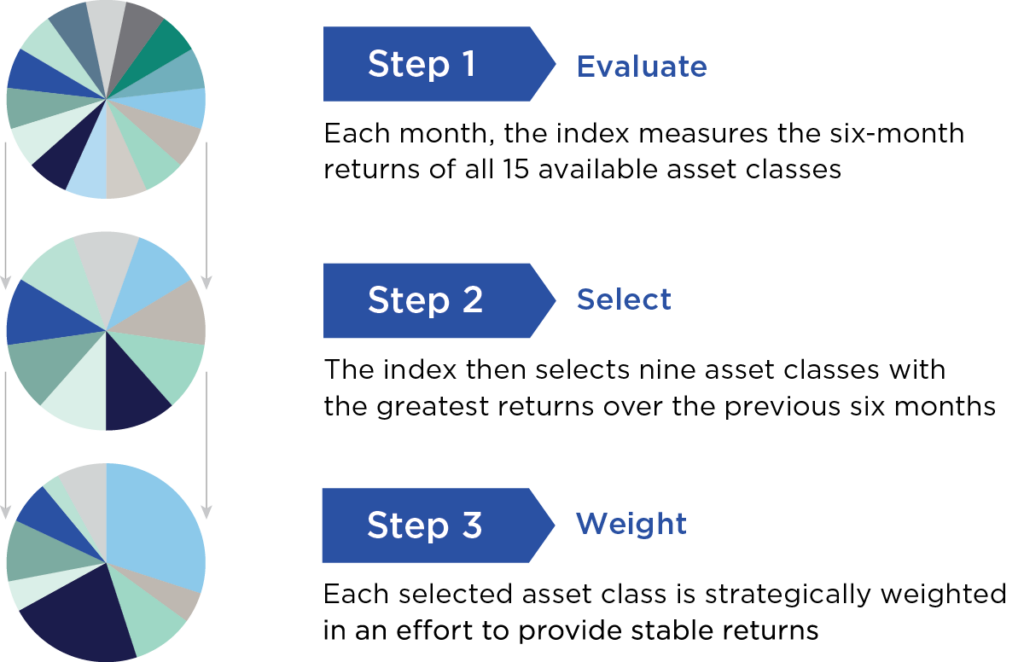

Monthly rebalancing may help generate more stable growth opportunities

“Stop-loss” feature: Asset classes are evaluated, selected and weighted monthly. If on any day the overall index’s weekly return is less than -3%, exposure is progressively decreased such that all allocations are removed by the end of the relevant week (the Index is effectively uninvested). After one week, the Index re-establishes allocations based on the monthly selection and weighting described above. To the extent the week following the triggering of the “stop-loss” feature sees an additional 3% decline, allocations will be removed over the course of an additional week. This may reduce the risk of potential short-term loss in the Index during a period of significant market distress but may also cause the Index to miss a potential recovery in the underlying asset classes. Past performance is not indicative of nor does it guarantee future performance.

The J.P. Morgan Mozaic II℠ Index was established on 12/28/2016.

15 global asset classes

J.P. Morgan is a global leader in investment banking and financial services with a proven track record of award-winning index design. J.P. Morgan leverages its deep expertise and best-in-class infrastructure to provide both retail and institutional investors with indices based on their various objectives.

The Nationwide Defined Protection Annuity® 2.0 is not available in MO, NY, OR, VA, VI as of 9/13/24.

Not a deposit – Not FDIC or NCUSIF insured – Not guaranteed by the institution – Not insured by any federal government agency – May lose value

This material is not a recommendation to buy or sell a financial product or to adopt an investment strategy. Investors should discuss their specific situation with their financial professional.

This product is sold by prospectus. This material must be preceded or accompanied by the prospectus. Carefully consider the investment objectives, risks, charges and expenses. The product prospectus contains this and other important information. Investors should read them carefully before investing. To request a copy, go to nationwide.com/prospectus or call 1-800-848-6331.

Index-linked annuity contracts are complicated investments. Prospective purchasers should consult with a financial professional about the Contract’s features, benefits, risks, and fees and whether the contract is appropriate based upon his or her financial situation and objectives.

Annuities have limitations. They are long-term vehicles designed for retirement purposes. They are not intended to replace emergency funds, to be used as income for day-to-day expenses or to fund short-term savings goals. Withdrawals are subject to income tax, and withdrawals before age 59½ may be subject to a 10% early withdrawal federal tax penalty. Please read the contract for complete details.

Nationwide Defined Protection® Annuity 2.0 is an individual single purchase payment deferred annuity with index-linked strategies issued by Nationwide Life Insurance Company, Columbus, Ohio. The general distributor is Nationwide Investment Services Corporation, Member FINRA. Please note that the Nationwide Defined Protection® Annuity 2.0 does not directly invest in an index. The product includes index strategies which follow market performance; however, they are not actual investments in the stock market.

This Index does not include income from any dividends paid by component companies. The exclusion of dividends from an Index may lower the Index Performance, particularly over the course of time.

J.P. Morgan Mozaic II℠ Index is an excess return index. Indexes calculated on an excess return basis include calculation elements that reduce index performance. Because of this, an excess return version of an index will have lower performance than a total return version of the same index would, especially in high interest rate environments. Some excess return indexes also deduct certain notional charges in calculating index performance. Any such deductions will reduce the potential positive change in index performance and increase the potential negative change in the index performance.

Guarantees and protections referenced within are subject to the claims-paying ability of Nationwide Life Insurance Company.

Neither Nationwide nor any of its affiliates are affiliated with JPMorgan nor any of its affiliates.

The J.P. Morgan Mozaic II℠ Index (“Index”) has been licensed to Nationwide Life Insurance Company (the “Licensee”) for the Licensee’s benefit. Neither the Licensee nor Nationwide Defined Protection® Annuity 2.0 (the “Product”) is sponsored, operated, endorsed, recommended, sold or promoted by J.P. Morgan Securities LLC (“JPMS”) or any of its affiliates (together and individually, “JPMorgan”). JPMorgan makes no representation and gives no warranty, express or implied, to contract owners taking exposure to the Product. Such persons should seek appropriate professional advice before making any investment. The Index has been designed and is compiled, calculated, maintained and sponsored by JPMS without regard to the Licensee, the Product or any contract owner. JPMorgan is under no obligation to continue compiling, calculating, maintaining or sponsoring the Index. JPMorgan may independently issue or sponsor other indices or products that are similar to and may compete with the Index and the Product. JPMorgan may also transact in assets referenced in the Index (or in financial instruments such as derivatives that reference those assets). These activities could have a positive or negative effect on the value of the Index and the Product.

Nationwide, the Nationwide N and Eagle, Nationwide is on your side, and Nationwide Defined Protection are service marks of Nationwide Mutual Insurance Company. © 2025 Nationwide

VAW-0276AO (1/25)