NYSE® Zebra Edge® Index

A behavioral finance strategy designed to provide consistent returns

Helpful Resources

“Behavioral finance could be the key to higher returns with less risk.”

Roger G. Ibbotson, PhD.

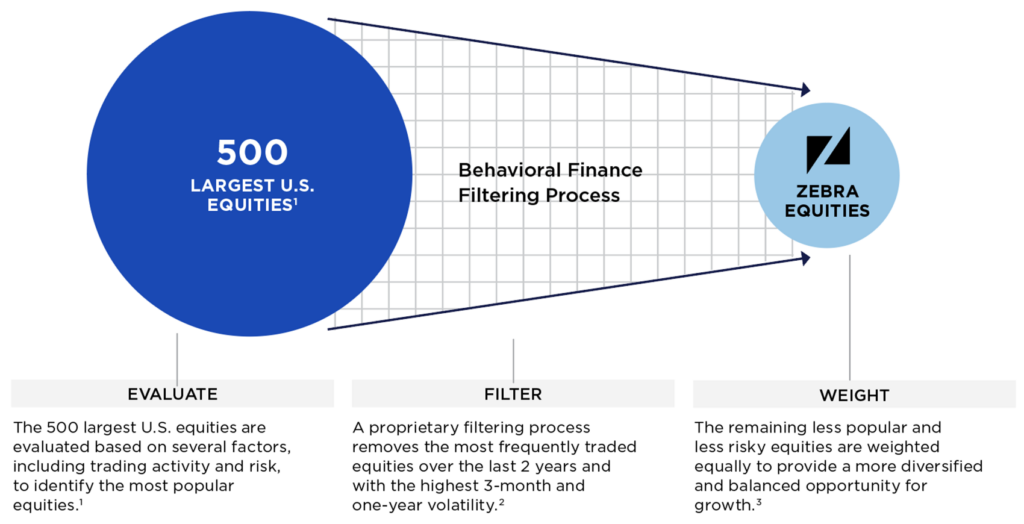

Zebra equity selection process

The NYSE® Zebra Edge Index applies a risk control methodology that can make daily adjustments to the allocation between having a leveraged exposure to Zebra Equities, U.S. Treasuries* and an interest-free cash account. This daily reallocation is designed to further reduce risk by targeting a volatility level of 5%. While this can lessen the impact of market downturns, it may also limit upside po*tential.

*U.S. Treasuries are tracked through U.S. Treasury futures.

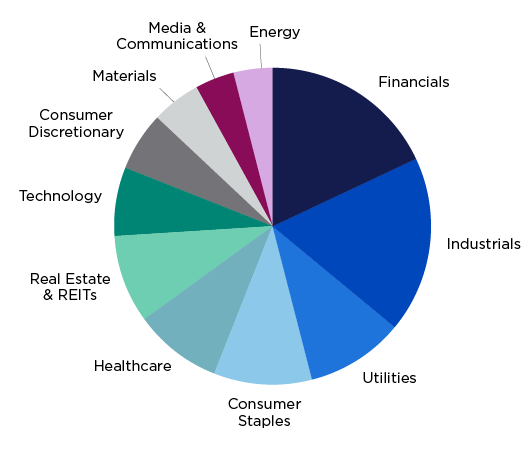

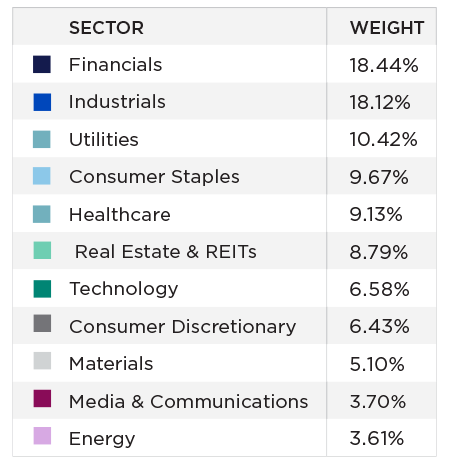

Sector breakdown & index weighting

Sector weights are calculated using non-risk control allocations as of December 31, 2024

Zebra Capital Management, LLC is an independent investment management firm managing equity-focused investment strategies. Founded in 2001 by Roger Ibbotson, Professor Emeritus of Finance at Yale University, Zebra has successfully combined his leading-edge research and scientific methods with decades of direct trading, risk management, and operational experience. Zebra’s strategies seek to generate superior performance without incurring additional volatility.

The Nationwide Defined Protection Annuity® 2.0 is not available in MO, NY, OR, VA, VI as of 9/13/24.

1 The 500 largest publicly traded companies in the United States is represented by the NYSE® U.S. Large Cap Equal Weight Index.

2 The equities with the highest volatility over the previous three months and prior year are removed, and equities with the highest trading frequency are removed.

3 Approximately 200 Zebra Equities are selected through this quarterly selection process. The selection process occurs in February, May, August and November. The NYSE® Zebra Edge® Index applies a risk control methodology that makes daily adjustments to the allocations between the Zebra Equities, U.S. Treasuries and an interest-free cash account. This daily re-allocation further reduces risk when markets are volatile, moving rapidly up or down. While this type of strategy can lessen the impact of market downturns, it can also lessen the impact of market upturns, potentially limiting upside potential.

Not a deposit – Not FDIC or NCUSIF insured – Not guaranteed by the institution – Not insured by any federal government agency – May lose value

This material is not a recommendation to buy or sell a financial product or to adopt an investment strategy. Investors should discuss their specific situation with their financial professional.

This product is sold by prospectus. This material must be preceded or accompanied by the prospectus. Carefully consider the investment objectives, risks, charges and expenses. The product prospectus contains this and other important information. Investors should read them carefully before investing. To request a copy, go to nationwide.com/prospectus or call 1-800-848-6331.

Index-linked annuity contracts are complicated investments. Prospective purchasers should consult with a financial professional about the Contract’s features, benefits, risks, and fees and whether the contract is appropriate based upon his or her financial situation and objectives.

Annuities have limitations. They are long-term vehicles designed for retirement purposes. They are not intended to replace emergency funds, to be used as income for day-to-day expenses or to fund short-term savings goals. Withdrawals are subject to income tax, and withdrawals before age 59½ may be subject to a 10% early withdrawal federal tax penalty. Please read the contract for complete details.

Nationwide Defined Protection® Annuity 2.0 is an individual single purchase payment deferred annuity with index-linked strategies issued by Nationwide Life Insurance Company, Columbus, Ohio. The general distributor is Nationwide Investment Services Corporation, Member FINRA. Please note that the Nationwide Defined Protection® Annuity 2.0 does not directly invest in an index. The product includes index strategies which follow market performance; however, they are not actual investments in the stock market.

This Index does not include income from any dividends paid by component companies. The exclusion of dividends from an Index may lower the Index Performance, particularly over the course of time.

NYSE® Zebra Edge® Index is an excess return index. Indexes calculated on an excess return basis include calculation elements that reduce index performance. Because of this, an excess return version of an index will have lower performance than a total return version of the same index would, especially in high interest rate environments. Some excess return indexes also deduct a notional charge(s) in calculating index performance. This deduction(s) will reduce the potential positive change in index performance and increase the potential negative change in the index performance.

Guarantees and protections referenced within are subject to the claims-paying ability of Nationwide Life Insurance Company.

Neither Nationwide nor any of its affiliates are affiliated with The NYSE® Zebra Edge® Index nor any of its affiliates.

The NYSE® Zebra Edge® Index has been licensed by ICE Data Indices, LLC (together with its subsidiaries and affiliates, “ICE Data Indices”) to UBS AG and sub-licensed by UBS AG (together with its subsidiaries and affiliates, “UBS”) to Nationwide Life Insurance Company (“Nationwide”). Neither Nationwide nor any Nationwide Defined Protection® Annuity 2.0 (the “Product”) is sponsored, operated, endorsed, recommended, sold or promoted by Zebra Capital Management, LLC (together with its subsidiaries and affiliates, “Zebra”), ICE Data Indices or UBS and in no event shall Zebra, ICE Data Indices or UBS have any liability with respect to the Product or the Index. Zebra, ICE Data Indices and UBS make no representations, give no express or implied warranties and have no obligations with regard to the Index, the Product or otherwise to any investor in the Product, client or other third party.

The mark NYSE® is a registered trademark of NYSE Group, Inc., Intercontinental Exchange, Inc. (“ICE”) or their affiliates and is being utilized by ICE Data Indices, LLC under license and agreement. The marks Zebra® and Zebra Edge® are registered trademarks of Zebra Capital Management, LLC, may not be used without prior authorization from Zebra Capital Management, LLC, and are being utilized by ICE Data Indices, LLC under license and agreement.

Nationwide, the Nationwide N and Eagle, Nationwide is on your side, and Nationwide Defined Protection are service marks of Nationwide Mutual Insurance Company. © 2025 Nationwide

VAW-0279AO (1/25)