SG Macro

Compass Index

A next-generation global multi-asset index seeking

to provide stable and consistent returns

Helpful Resources

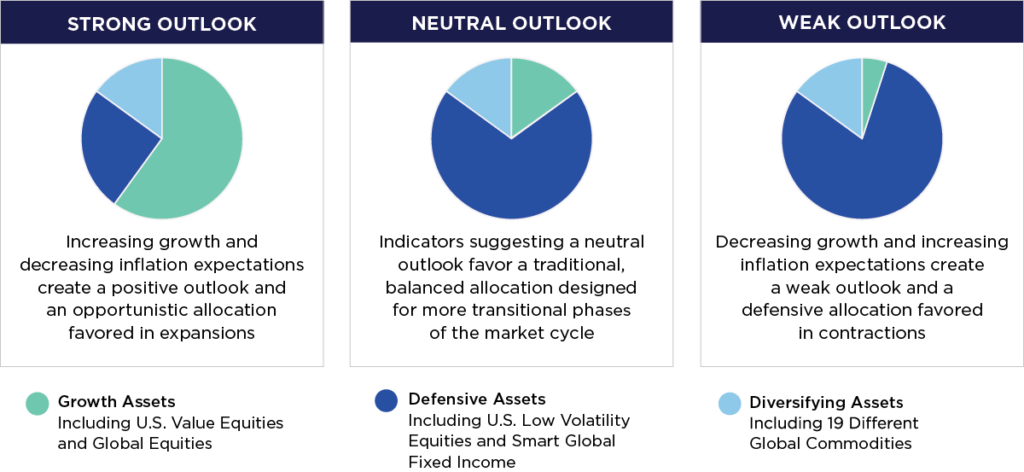

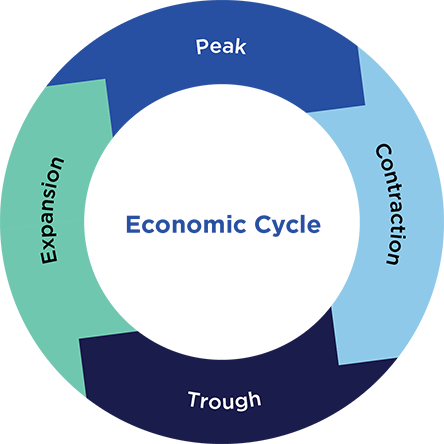

The SG Macro Compass Index is a global multi-asset index designed to identify changes in the economic cycle and rotate asset class allocations through up, down, and sideways markets. There can be no guarantee that the SG Macro Compass Index strategy will meet its objectives.

The Index is deeply rooted in academic research of macroeconomic outlooks and applies a rules-based process designed by one of the world’s leading index providers committed to building a better and more sustainable future through responsible and innovative financial solutions.

- 150 years of client service

- Operations in 66 countries

- Over 26 million clients worldwide

The Nationwide Defined Protection Annuity® 2.0 is not available in MO, NY, OR, VA, VI as of 9/13/24.

Not a deposit – Not FDIC or NCUSIF insured – Not guaranteed by the institution – Not insured by any federal government agency – May lose value

This material is not a recommendation to buy or sell a financial product or to adopt an investment strategy. Investors should discuss their specific situation with their financial professional.

This product is sold by prospectus. This material must be preceded or accompanied by the prospectus. Carefully consider the investment objectives, risks, charges and expenses. The product prospectus contains this and other important information. Investors should read them carefully before investing. To request a copy, go to nationwide.com/prospectus or call 1-800-848-6331.

Index-linked annuity contracts are complicated investments. Prospective purchasers should consult with a financial professional about the Contract’s features, benefits, risks, and fees and whether the contract is appropriate based upon his or her financial situation and objectives.

Annuities have limitations. They are long-term vehicles designed for retirement purposes. They are not intended to replace emergency funds, to be used as income for day-to-day expenses or to fund short-term savings goals. Withdrawals are subject to income tax, and withdrawals before age 59½ may be subject to a 10% early withdrawal federal tax penalty. Please read the contract for complete details.

Nationwide Defined Protection® Annuity 2.0 is an individual single purchase payment deferred annuity with index-linked strategies issued by Nationwide Life Insurance Company, Columbus, Ohio. The general distributor is Nationwide Investment Services Corporation, Member FINRA. Please note that the Nationwide Defined Protection® Annuity 2.0 does not directly invest in an index. The product includes index strategies which follow market performance; however, they are not actual investments in the stock market.

This Index does not include income from any dividends paid by component companies. The exclusion of dividends from an Index may lower the Index Performance, particularly over the course of time.

SG Macro Compass Index is an excess return index. Indexes calculated on an excess return basis include calculation elements that reduce index performance. Because of this, an excess return version of an index will have lower performance than a total return version of the same index would, especially in high interest rate environments. Some excess return indexes also deduct a notional charge(s) in calculating index performance. This deduction(s) will reduce the potential positive change in index performance and increase the potential negative change in the index performance.

Guarantees and protections referenced within are subject to the claims-paying ability of Nationwide Life Insurance Company.

Neither Nationwide nor any of its affiliates are affiliated with the SG Macro Compass Index nor any of its affiliates.

The SG Macro Compass Index (the “SG Index”) is the exclusive property of SG Americas Securities, LLC (together with its affiliates, “SG”). SG has contracted with S&P Opco, LLC (a subsidiary of S&P Dow Jones Indices LLC) (“S&P”) to maintain and calculate the SG Index. “SG Americas Securities, LLC”, “SGAS”, “Société Générale”, “SG”, “Société Générale Indices”, “SGI”, and “SG Macro Compass Index” (collectively, the “SG Marks”) are trademarks or service marks of SG. The SG Index has been licensed to Nationwide Life Insurance Company (the “Licensee”) for use in the Nationwide Defined Protection® Annuity 2.0 (the “Product”). SG’s sole contractual relationship with the Licensee is as licensor of the SG Index and the SG Marks. SG has no obligation to make payments under the Product. None of SG, S&P or other third-party licensor (collectively, the “SG Index Parties”) to SG is acting, or has been authorized to act, as agent of the Licensee or has sponsored, promoted, solicited, negotiated, endorsed, offered, sold, issued, supported, structured or priced any Product or provided investment advice to the Licensee. The SG Index Parties make no representation or warranty, express or implied, to investors in the Product and hereby disclaim all warranties (including, without limitation, those of merchantability or fitness for a particular purpose or use): (a) regarding the advisability of investing in any products linked to the SG Index or (b) the suitability or appropriateness of an exposure to the SG Index in seeking to achieve any particular objective, including meeting its stated target volatility. No SG Index Party shall have any responsibility or liability for any losses in connection with the Product, including with respect to design, issuance, administration, actions of the Licensee, marketing, trading or performance of the Product. SG has not prepared any part of this document and no statements made herein can be attributed to SG. SG does not act as an investment adviser or provide investment advice in respect of the SG Index or the Product and does not accept any fiduciary or other duties in relation to the SG Index, the Licensee, the Product or any investors in the Product. SG shall have no liability for any act or failure to act in connection with the determination, adjustment or maintenance of the SG Index. Without limiting the foregoing, SG shall have no liability for any damages or lost profits, even if notified of the possibility of such damages. In calculating the daily performance of the SG Index, SG deducts fixed transaction and replication costs that cover, among other things, rebalancing and replicating the SG Index. The total amount of these embedded costs is unpredictable and depends on numerous factors, including leverage of the SG Index, which may be as high as 200%, performance of indexes underlying the SG Index, market conditions and changes in the macro regimes, among other factors. The embedded costs, which are increased by the SG Index’s leverage, will reduce the performance of the SG Index. The volatility control applied by the SG Index may also reduce the overall return.

Nationwide, the Nationwide N and Eagle, Nationwide is on your side, and Nationwide Defined Protection are service marks of Nationwide Mutual Insurance Company. © 2025 Nationwide

VAW-0275AO (1/25)